Building Winning Pitch Decks

As a product development studio with an entrepreneurial spirit, located in the 6th largest startup ecosystem globally, we have seen our fair share of pitch decks. They run the gamut from amazing stories that simply need a little typographic help… to clear cries for help.

Over the years we’ve developed a point of view about best practices for this very specific type of storytelling. We have refined it through our work for diverse product and service offers across consumer and commercial startups. We’ve even pressure tested it with our own internally incubated startups via Sprout Labs, pitching investors ourselves. After a recent flurry of activity with some fast-moving, post-COVID pitch teams, we have formalized our Pitch Deck Process— how we help our clients develop a story with the poise and tone of voice they’ll need to capture the imagination of the investment community.

In our blog this month, Sprout Creative Director Matthew Evans, who leads our development efforts for pitch deck work, shares a high-level intro to the process. He explains the decision-making processes we use to help startups craft a story that will secure the investments they need to take their ideas to the next level. What to say. What to avoid saying. And what evidence to include that will be relevant and convincing.

As a bonus to all of our entrepreneurial spirit animals, we’re also sharing a comprehensive PDF download to jumpstart your pitch planning. CLICK HERE to download.

Why Pitch?

No matter where you are in the process of ramping up a business idea you need a concise way to tell your story. An elevator pitch, maybe. Or a deck you are using to recruit talent or sign-up initial clients. But when the need shifts to approaching Angel, Private Equity, or Venture Capital investors, the stakes change. Before it was about your money. Now it’s about theirs. And they expect you to be buttoned down. And buttoned down in a very specific way.

The Pitch Deck has become a critical calling card for introducing ideas to capital. Over the past 20+ years, after the dot-com craze super-charged the startup movement, the form that they take has become, well, formalized. They are now all about the same length and feature similar mandatory and desirable information.

For startups, standardizing the protocol levels the playing field. Every idea has a chance. But the process is also Darwinian. Poorly communicated ideas will fail. While well-communicated ideas earn the right to continue the conversation. For investors, Pitch Decks standardize the process for moving through overtures in volume, as investors are required to do. But it can also make the process seem coldly decisive about winners and losers.

As professional storytellers with a passion for entrepreneurial thinking, we have developed an expertise in helping clients with great ideas create Pitch Decks that stick the landing. In this post we share some of our best practices for planning and executing better decks, drawing from over 20 years’ experience working with startups. No matter what form your idea, business, or brand is in at the point when you need to pitch, the Sprout approach makes the process go faster, reduces risk, and has a proven track record to help secure an investment.

It Helps to Have a Process

We’ve found that the same process we use to guide the development of everything we produce at Sprout is a solid backbone for building a Pitch Deck (i.e., Immerse, Examine, Explore, Expand, Evaluate, and Execute). It establishes goals and milestones. It makes organizing assets more orderly and identifies gaps. It also helps divide the work between our creatives and the startup founders who must ultimately provide the content we agree is critical to winning investment.

Like all great communications projects we begin with the audience. What will your stakeholders find relevant and persuasive? While decks have a core story for the investment community overall, there are wrinkles based on the type of investor, the size of the ask, and the terms you or they expect at the end. We start there.

Next, we put some structure around the basics needed for storytelling. Given the brevity of the presentation, the mission is to inspire. Not to coax or wax on. This means narrowing from all the stories you could tell, to the story you should and must tell to get to the next stage. This phase guides our thinking about the images, prose, and figures (existing or to be developed) that will give the story character, rigor, and believability.

Finally, we align around the story that we will tell together. The fundamental structure of a traditional pitch deck structure is clear. There are must-haves. But there are also nice to haves — expansion joints that you can flex to celebrate the things about your story that create value and differentiate you in the marketplace.

Every Pitch is a Story

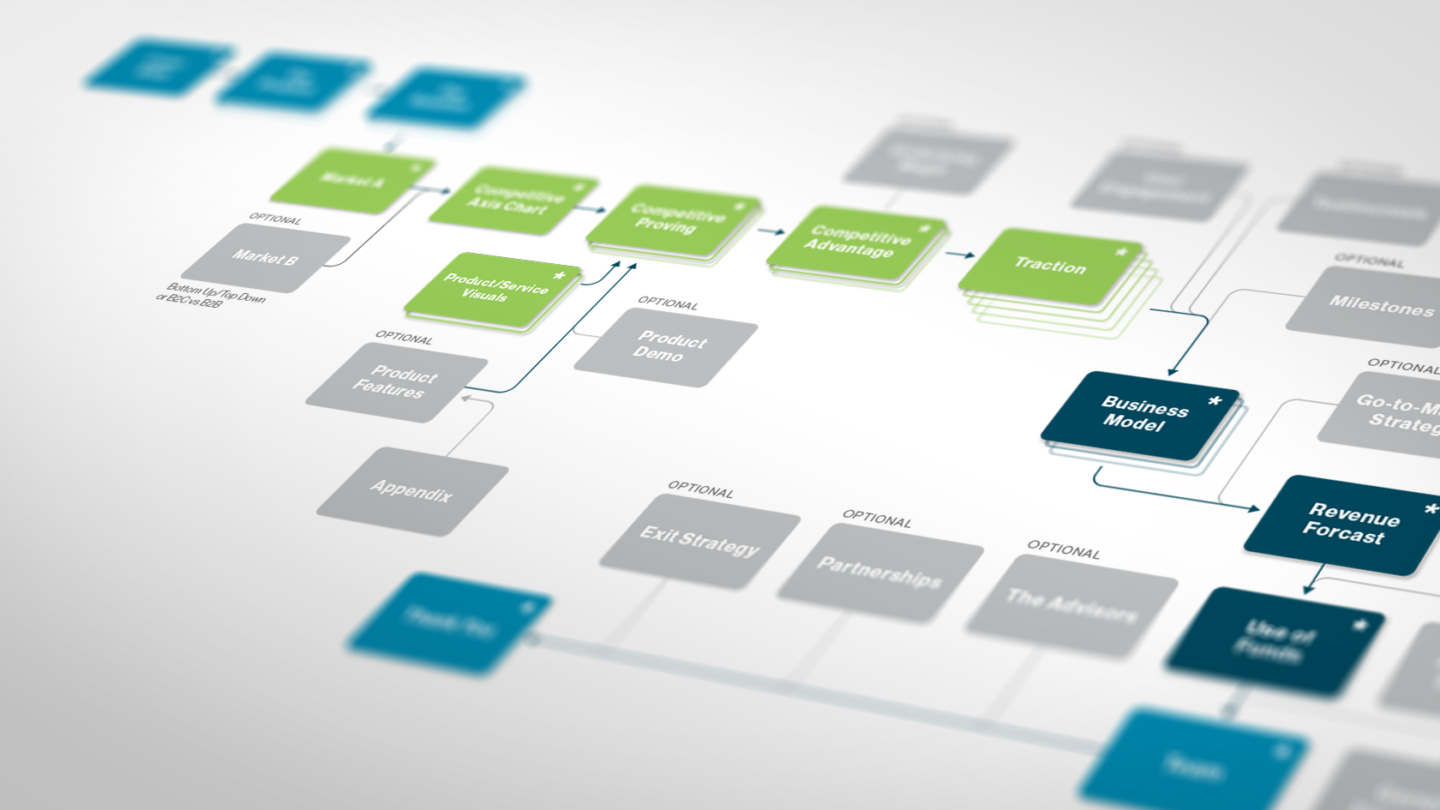

This storyboard is like a map of the journey on which you are taking the audience. Every story behind a great business idea is magical and special, to you. But investors expect it to have a beginning, a middle, and an end, about 3-5 minutes later. Which requires message discipline. This isn’t a negative. It is an opportunity to concentrate the power of your ideas into a story with staying power.

In overview form, it’s like a subway with express routes and optional stops. To respect the 3-5 minute rule every slide must count. There can only be detours if they add value. Being more concise on other must-have items may free up time. But it is ultimately a zero-sum game. Pick your battles.

Express Route & Options

We think about the journey as having four segments:

1 The Why | The unresolved problem + your solution

2 The Wow | Your market analysis + competitive advantage

3 The How | Your business case + its money flows.

4 The Who | Your core team + a thank you.

Each section includes the requirements and the options we’ve mentioned. In our work together we consult with clients on what to include and exclude. What to visualize and what to say. What to show and say to ensure that key ideas are reinforced. It also suggests opportunities to let your story breathe in areas where you have powerful evidence, compelling IP, or partners to showcase.

1 The Why | The unresolved problem + your solution.

These slides cut to the chase on the unmet need in the market which your team has identified as profound, growing, and untapped. Then it aligns with the insight-based solution you have conceived to address this market opportunity.

This setup is the crux of the story. It requires precise rhetoric, using words and pictures that ‘take you there’ by conveying the need as visceral and believable, and then revealing the solution as first inspired and then inevitable.

This section can expand (judiciously) if we agree that either the problem or the solution becomes more compelling if you add relevant texture to the need or stature to the promise. When the final draft is in the final review you can make this call.

2 The Wow | Your market analysis + competitive advantage.

This section starts with a slide that puts your target market in stark relief. What category are they in? What segment do they represent? How big is this universe now? What is its rate of growth? What is the size of the prize?

Next comes a view of the competitive landscape. The terrain where lesser offers are struggling to reach that audience. And the white spaces where gaps exist to build new markets, take share, or both. This premise is then backed up with evidence of your competitive advantage i.e., compelling new benefits, features, or revenue models. If a ‘demo’ will help land the punch, this is the place to throw it.

Finally, the “Wow” needs evidence for the market traction you expect your competitive advantage to achieve. Who will become your customers and why? Initially? Thereafter? Who will switch and why? How many will stay on? How will you monetize their loyalty?

This section is a bit of a dance. And it becomes more challenging when a secondary market will generate revenue critical to the overall value proposition. As with section one, the choice to go deeper here may be a wise one if it makes the prize appear larger and/or the competitive advantage more defensible.

3 The How | Your business case + its money flows.

To be frank, this section is the oxygen that investors breathe every day. If imagining a better world animates sections 1 and 2, solving for “x” drives section 3. Numbers don’t lie. But they will just lie there if poorly structured and presented.

The baseline here is the financial summary of the current business and the projected revenue flows over time. How are we making money now? How are those proceeds being used? What are you charging? Is it sustainable? Is it repeatable? More importantly, is it scalable? The next slide (or sequence) shows how you project revenues to grow. For investors who have an eye on their exit, the rate of growth will be critical. These figures need to be simple and logical in the way they are calculated and clear and compelling in the way they are presented.

This section ends with a postcard from the future about how the startup would invest the funding sought to amplify and/or accelerate the forecast just presented. As with the forecast, these allocations must be explicit, clear, and credible. For investors, this is the money shot.

Depending upon your circumstances as a startup, this section may also warrant more detail. Do you have other investment sources to disclose? Do you have other funding rounds planned? Do you have a war chest that reflects your sweat equity? Would any of these allay investor concerns? Or do they just distract from the big idea?

4 The Who | Your core team + a thank you.

The final sequence is about the team behind the project. This is typically a single slide that presents the relevant bona fides of the C-Suite driving the initiative. But it can grow to include strategic business partners or key business advisors.

For businesses where partnerships provide paths to market that can accelerate growth, showing that synergy can indicate a tailwind for early marketing success. For businesses where true subject matter experts can reduce risk by vetting the offer or providing insights that drive next-stage product development, name-dropping may be well worth the investment in a slide.

Production Values Matter

A great storyboard and a tight outline, organized with discipline to touch all the bases, is sadly the cost of entry. Great decks stand apart from mediocre ones when they have taken the time to ensure that their production values also tell a story. Like great brands, they have several ways to communicate your passion and maturity as a business.

The obvious lever is the way they look and feel. Even if your brand is still coming together, how you present yourself graphically is a choice. Make great choices. This includes developing believable and relevant imagery to grab and hold attention. This may mean that we work with clients to visualize not-yet-real concepts that crystallize what they are promising. It also includes making sure that identity, color, typography, and the visual design of figures, metrics, and timelines are crisp and clear.

Decks also communicate through their tone of voice, since how you tell your story reinforces your command of the material and confidence in its vision. In a presentation moving swiftly toward an explicit request, there is no room for “could, can, maybe, should, perhaps” language. We work with clients to make sure that decks are authoritative, when necessary, imaginative where appropriate, and that they allow the founders’ personality to shine through.

Finally, given how short they are, Pitch Decks necessarily communicate a point of view. What did you include and why? What did you leave out and why? Your perspective will emerge from these choices. The things you choose to focus on will give depth and texture to the story you want your deck to tell. And while they all follow a formula, the best are personal and bespoke.

Having made all these communications choices, Pitch Decks are not TED-decks, where the slides don’t tell a complete story without a presenter. Because these decks often travel without a voice-over, we make sure that there’s a through-line in the slides that work well for their second life as a PDF attachment. You never know when an informal ‘Have you seen this?’ exchange may be the spark that moves an idea along.

Ultimately, You Are the Story

When you talk with investors who listen to pitches for a living they say that the “wow” behind the “why” of any pitch comes when a confident presentation animates the content of the deck.

That’s why we work with clients to rehearse and refine what to say and how to say it. In fact, our process ends with us pitching our clients their story as if they were the investor. That way we can both fine-tune what to emphasize, when to give ideas a chance to breathe in a silent room, and how, specifically, to ask for the order.

When it all comes together, the deck is a platform for a business creator to tell their story with passion and confidence in front of any room. The more command they have of the material, the easier it becomes for them to rock the deck as they read the room.